Value investing in the Climate Space

Moat factors in Climate investing

This post is a cursory look into the factors which makes climate tech companies intrinsically valuable. There's more to investing in climate tech than just making profit. Some companies are doing amazing things for our planet, and the intrinsic value from their work can pay off in the long run for everyone.

Disclaimer: This post is not investment advice, and I have investments in some of the companies mentioned.

Let's dive into some of the qualitative factors that help climate companies build moat with examples of companies doing it.

Building a fortress: The moat factors in Climate tech

Manufacturing expertise as a competitive edge

Companies with a solid base in research and development (R&D), combined with deep expertise in manufacturing, often enjoy a significant market advantage. These "deep tech" companies, with hard-to-replicate skills, especially in production, are poised to stay ahead of the competition. Tesla's recent moves are a prime example of this trend. In the semiconductor industry, TSMC stands out as a testament to the power of manufacturing prowess. Their mastery of advanced chip production, coupled with the high costs and complexities of the required equipment, has created a substantial barrier to entry. This has solidified their position as the world's leading chip supplier.

A deep dive into technology requires ongoing R&D to build a strong foundation. This provides a significant moat in terms of intellectual property (IP). The manufacturing layer further reinforces this moat, as producing novel technologies is an inherently challenging and iterative process.

The food industry is ripe for innovation, particularly in the face of pressing challenges. Climate change is taking a toll on crop yields, and labor shortages are becoming increasingly common in developing countries, affecting both agriculture and food service. To address these issues, companies with expertise in manufacturing food processing equipment and a focus on decentralized distribution will be in high demand. These solutions can help increase efficiency, reduce waste, and ensure a more sustainable food supply.

Upcycling: Circular economy in action

The old saying, "One man's trash is another man's treasure," perfectly encapsulates the circular economy principle. While a completely circular system may be ideal, the reality is that full recovery and upcycling of materials is often impractical. Nevertheless, a partial circular economy still offers significant benefits in terms of resource and energy efficiency.

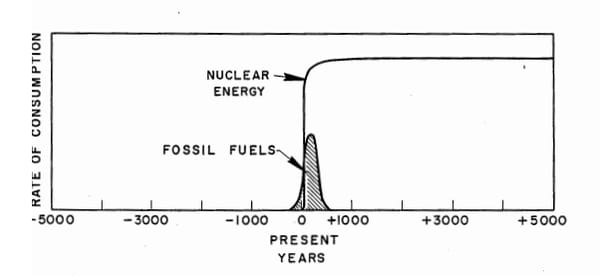

Given the looming constraints on rare earth metals and critical minerals and non-renewable nature of fossil fuel reserves, adopting circular practices has become increasingly imperative for businesses. Two US-based companies, Redwood Materials and Crusoe Energy, are leading the charge.

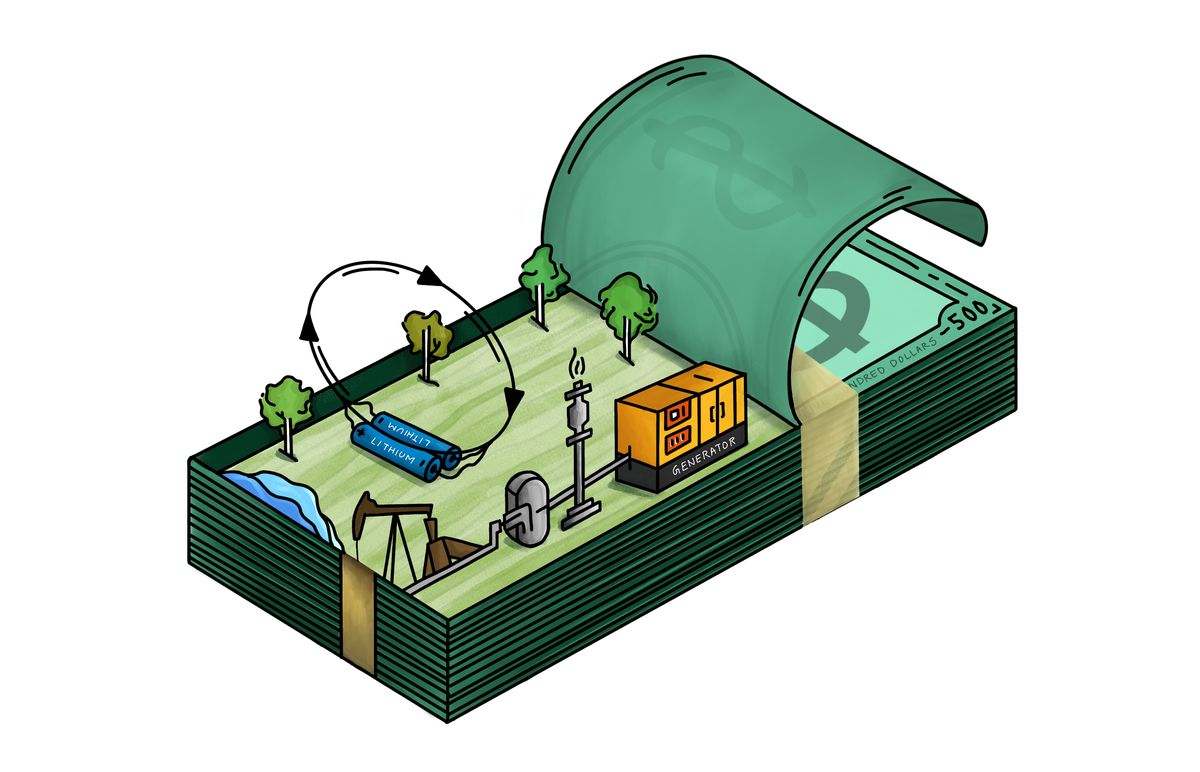

Redwood Materials is creating a closed-loop supply chain for lithium-ion batteries, encompassing collection, refurbishment, recycling, refining, and remanufacturing. This approach significantly reduces battery waste in landfills.

Crusoe Energy's Digital Flare Mitigation (DFM) system is another innovative solution. By capturing wasted natural gas from oil fields and converting it into electricity to power modular data centers, DFM addresses the environmental issue of flaring (methane emissions) while also meeting the growing energy demands of AI commercialization. This technology offers a productive way to divert flared gas and reduce emissions in the oil and gas industry.

From Space to Shelves: Leveraging military and space tech

Companies that can harness the knowledge gained from space and military research often gain a significant competitive edge. Products designed for the extreme conditions of space must be incredibly durable and reliable, making them well-suited for terrestrial applications.

History is filled with examples of innovations that originated in space or military research and later found their way into everyday life. NASA's inventions[1], like freeze-dried food, memory foam, and wireless headsets, are just a few examples. Similarly, the internet, GPS, and microwave ovens all have their roots in military research[2]. The urgent needs of these sectors often drive innovation and lead to groundbreaking discoveries. While these inventions eventually trickle down to the public domain, entrepreneurship plays a crucial role in accelerating this knowledge transfer.

The Smart Tire Company and Henson Shaving are two examples of companies that have successfully commercialized technologies developed for space applications. NASA originally created a super-elastic tire for Mars missions, designed to withstand extreme temperatures and challenging terrain. The Smart Tire Company has adapted this technology for terrestrial use, creating an airless, durable tire made from a special shape memory alloy called Nitinol. This innovative tire offers a significant value proposition for vehicle owners, as it requires no maintenance or replacements.

Henson Shaving has taken a similar approach, developing a razor made from aerospace-grade aluminum. This eco-friendly and long-lasting razor offers a compelling alternative to disposable options. While their business model may not rival established players in the shaving industry, the long-term value they provide to customers is undeniable.

Battling tiny threats: Innovative solutions for micro-pollutant removal

In today's consumer-driven world, it's refreshing to see companies tackling pressing environmental issues. The Tyre Collective, a UK-based startup, is taking on the challenge of vehicle rubber wear, a significant source of microplastic pollution in our oceans and a major air pollutant.

Their innovative solution is an electrostatic collector that attaches to the rear mud flap of vehicles. As the vehicle moves, the collector captures the tiny rubber particles emitted from the tires. This device has minimal impact on fuel efficiency. The collected tire wear can then be recycled to create retreads for truck tires or upcycled into shoe soles, demonstrating the circular economy in action.

The Tyre Collective is currently piloting their device with Rivian, an electric vehicle manufacturer, and aims to eventually persuade regulators to include tire wear in vehicle emission standards. With the global number of vehicles on the rise, supporting the Tyre Collective is a sensible step towards a cleaner planet.

Embrace interdisciplinary collaboration

In today's fast-paced, hyper-competitive business environment, the importance of interdisciplinary collaboration is often overlooked. The relentless pursuit of economic growth can lead to siloed teams and a neglect of the benefits that can arise from cross-functional interactions.

Interdisciplinary collaboration not only fosters professional development and improves mental health among employees but also opens the door to unexpected discoveries. These "happy accidents" can lead to innovative new products and services, expanding a company's business options and building resilience in challenging times.

Balancing short-term profitability with investments in interdisciplinary projects can be difficult, but the long-term rewards are substantial. By embracing a more collaborative and holistic approach, companies can position themselves for sustainable success.

Hedging your bets

When it comes to technology, investors often rely on Technology Readiness Level (TRL) to derisk their investments. Developed by NASA in the 1970s, TRL measures the maturity of a technology, from early-stage research to full-scale deployment. TRL's are based on a scale from 1 to 9, with 1-3 being the "Research” stage, 4-6 representing “Development”, and grades 7-9 being actual “Deployment”. Naturally, higher TRL's lowers the investment risk.

Investors often encounter competing investment opportunities with similar TRL's. To mitigate risk in these situations, hedging can be a valuable strategy. For example, consider the Tyre Collective and the Smart Tire Company. Both are working to reduce the environmental impact of the automotive industry, and both could be considered in the same TRL bracket. If the Smart Tire Company successfully scales up its elastic tire technology, traditional rubber tires might become obsolete. On the other hand, if rubber tires remain the standard, the Tyre Collective's tire wear collection device could become a regulatory requirement, boosting its market potential.

By investing in both companies, an investor can hedge their bets and increase their chances of success, regardless of which technology ultimately prevails. In a similar vein, I have hedged my bets on content writing platforms by investing in Substack but using Ghost to host my articles. I invite readers to share their own examples of 'hedging pairs' in the comments section.

Breaking down barriers: Equitable access to Climate investing

Historically, angel and venture capital investing has been a domain primarily accessible to the wealthy. The requirement for a net worth of at least $250,000 (excluding primary residence) to qualify as an accredited investor for venture capital investing has created significant barriers to entry for lower wealth individuals, especially from the Global south.

Fortunately, the emergence of Equity-based crowdfunding platforms like Wefunder and Crowdcube has democratized private investing by lowering minimum ticket size. This has helped provide more people with the opportunity to invest in private companies. These two platforms list companies from all sectors. Climate Insiders is a complete climate-focused and equity-based crowdfunding platform. They do charge annual subscription fee to participate in the investing rounds unlike the former two platforms.

Climate founders also have a responsibility to use crowdfunding platforms to raise capital, rather than relying solely on traditional venture capital firms. This can help to counter the effects of "VC gatekeeping," which can unfairly exclude lower net worth investors. Personally, I have experienced the frustration of being unable to invest in promising climate tech companies due to accreditation requirements. However, crowdfunding platforms have allowed me to support some of the businesses discussed in this article.

I would end this article by inviting readers to share their thoughts on this article in the comments section.

PS: I used Gemini to augment my write up with tonal changes and header refinements.

References

- https://www.jpl.nasa.gov/infographics/20-inventions-we-wouldnt-have-without-space-travel/ ↩︎

- https://www.nato.int/cps/fr/natohq/declassified_215371.htm?msg_pos=1 ↩︎

Buy me a coffee or support via Paypal (both links below) if you enjoyed reading this post and found it insightful. Would love to hear your comments on the article.

Please subscribe as well. Appreciate your support!

Content writing for Anabe Labs by Rajesh Hegde is licensed under CC BY-SA 4.0